Gift Card Reports

Gift Card Reports

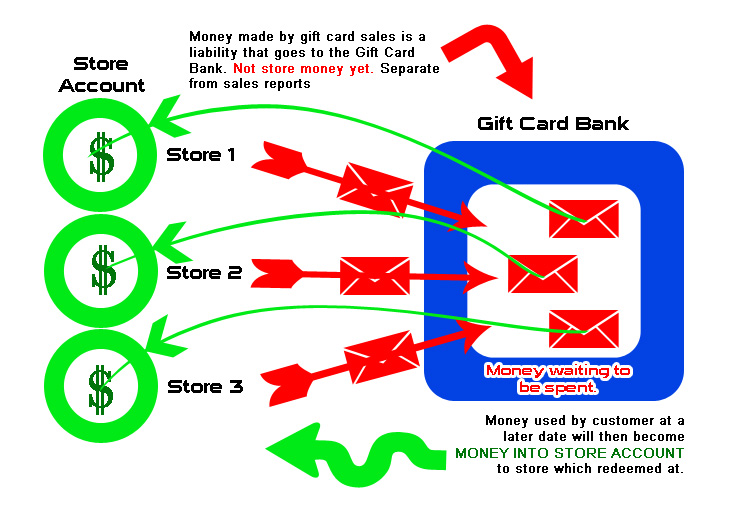

Today Sintel Systems is addressing what happens to your money and your reports when you sell gift cards. If you’ve made any gift card sales today you won’t be receiving any of that money when you make your settlement for the night. Gift cards are a liability and should be looked to as a different entity from your regular sales. Issuing a card is more of an exchange of tender then a sale. This means that you have not sold any products but only exchanged cash for “your store” money. Essentially you are becoming the bank for your customers. For single store locations this is fairly simple and easy to see incoming and outgoing money because the funds are kept in house. For multiple store setups such as franchises the funds need to be collected and distributed based on how each store performs. In other words, if you are part of a franchise you are sending that money to your franchise gift card bank. You are basically holding their money to be used at a later date. Only when an item is paid for using a gift card, the sale is considered revenue and does that money belong to your store.

Although perfectly correct this can have negative physiological effects. For example let’s assume your store is part of a franchise with 50 store locations and in one month you sold $1000 in gift cards. In that same month only $100 were redeemed by your customers. In this case at the end of the month you would owe $900 to the pool account. If your total sales for that month are $9,000 it is difficult to digest that you owe 10% of your revenue.

Here is a simple diagram of how the process works:

When looking at reports for the day be sure to view gift cards sales separate from your total sales for the day.

When looking at reports for the day be sure to view gift cards sales separate from your total sales for the day.

{{block type=”cms/block” name=”custom.block” block_id=”blog_post_footer”}}